The Enduring Popularity of Turn-Based Gacha Games

Turn-based gacha games have stayed popular because they sit at the intersection of strategic depth, anime-style collection appeal, and a mobile-friendly, low-friction format that fits modern play habits. Even as real-time action gachas explode, the data and community discussions show turn-based systems still command a large slice of the market and player attention.

Strategy without stress

Turn-based combat lets players think, plan, and optimise teams without the execution pressure of action combat.

- Players often cite the core appeal as “planning and decision-making,” where each turn and team composition choice carries more weight than raw reflexes.

- Tactical RPG-style systems with speed manipulation (e.g., combat readiness, turn order hacks) give room for deep theorycrafting and team synergies, which gacha’s large rosters can support very well.

For many mobile players, this combination is ideal: you can play on a commute or at work, pause between turns, and still feel like you are engaging with a thoughtful game rather than just auto-slashing.

Perfect fit for mobile and modern life

Turn-based gachas align neatly with how people actually use phones.

- Market reports note that mobile already accounts for over 60% of gacha revenue, with turn-based combat representing about 35% of gameplay mechanics in the segment, especially within RPGs.

- Players point out that these games “can be played in short time and anywhere,” only needing a phone and a connection, which matters in regions where consoles and premium titles are expensive or less common.

Idle-like battle flows, auto-repeat, and energy systems make it easy to slot progress into small time windows, while the more complex content (hard bosses, challenges) can be tackled at your own pace, without twitch skill barriers.

Collection, anime aesthetics, and gacha psychology

Turn-based gacha RPGs are built around collecting and optimising characters, which taps into both aesthetic and psychological drivers.

- Industry analyses show anime-styled RPG gacha titles dominate revenue and engagement, with “RPG” contributing around 40% of gacha market revenue and anime art styles powering roughly 50% of market share.

- Players and analysts repeatedly mention “waifus,” IP attachment, and long-term account progression as major hooks, with gacha layers (rarity, rate-ups, limited banners) amplifying the thrill of chance.

Turn-based combat plays well with these systems because:

- Team-building is front-and-centre: putting your favourite units together and seeing them synergise is “half the fun,” and having turns makes each interaction readable and satisfying.

- The gacha loop (collect–upgrade–optimise) meshes with RPG progression, which is why market reports position gacha RPGs as a key growth driver within an industry projected to nearly double in value between 2023 and the early 2030s.

Monetisation that sustains constant updates

Gacha monetisation is controversial, but it is also what funds the constant content pipeline that keeps these games alive for years.

- Recent research and market reports highlight gacha as a microtransaction strategy that leverages cognitive biases (sunk cost, near-miss effects, FOMO) to keep players engaged and spending.

- Community discussions acknowledge that while gacha can “suffocate” mobile with predatory designs, it has also raised production values: to justify monetisation, developers invest in better art, music, story, and systems.

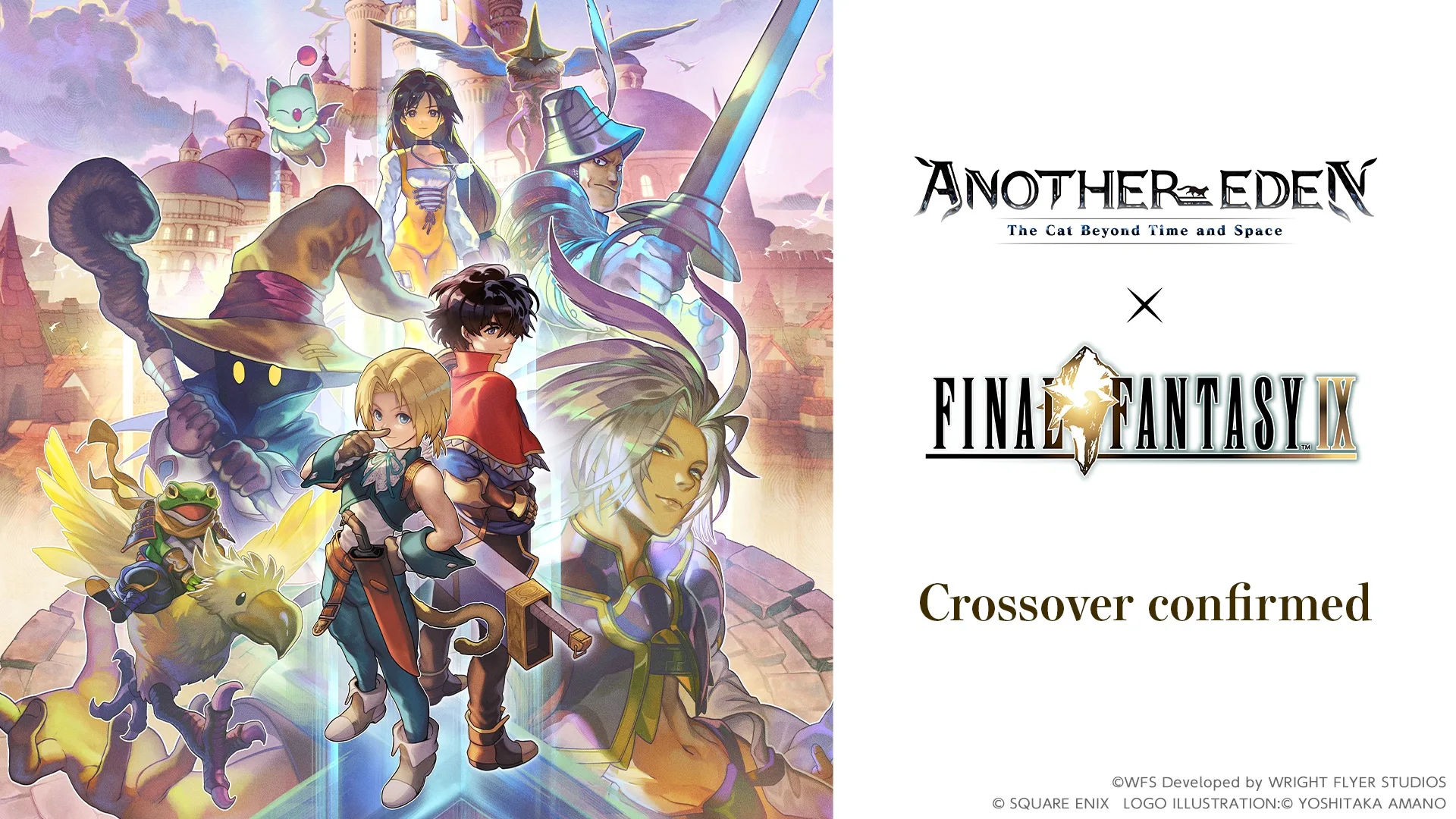

Turn-based gacha RPGs especially benefit from this: story chapters, new characters, events, collaborations, and challenge modes are rolled out on a cadence that would be hard to sustain in a buy-to-play model, and players accept the trade-off as long as the underlying game feels enjoyable and reasonably fair.

Community, cross-audience overlap, and future outlook

Turn-based gacha games also endure because they concentrate large, overlapping communities around a familiar formula.

- Audience analyses show huge overlap between viewers of top anime-styled gacha games; for instance, over 70% of people who watch Honkai: Star Rail streams also watch other big anime gacha titles, while more Western-style or non-turn-based gachas share much smaller overlaps.

- Market forecasts project the gacha sector growing at roughly 8–10% CAGR into the early 2030s, with Asia-Pacific as the largest region and RPG/turn-based titles retaining a major share of that spending.

Criticism around predatory monetisation, burnout, and market saturation is getting louder, but even those critiques concede that players keep coming back because these games offer high-quality, content-rich experiences for essentially zero upfront cost, especially in the turn-based RPG space, where design can lean more on systems and less on expensive real-time animation.